sábado, 27 de fevereiro de 2021

Carl Menger

Today marks the 100th anniversary of the. death of Carl Menger, on February 26, 1921. Two years ago at this time, I posted a translation that I did of Friedrich von Wieser's memorial essay on Carl Menger's life and influence, especially on himself and his equally famous brother-in-law, Eugen von Boehm-Bawerk. It had not previously appeared in English. I thought it might be appropriate to repost it today in honor of the founder of the Austrian School of Economics:

Macroeconomia

"Critiques of mainstream macroeconomics are common among Austrian economists. In a new book, titled Macroeconomics as Systems Theory, Richard Wagner goes further. He starts with Erik Lindahl’s distinction between microeconomics as individual action and macroeconomics as interaction. He then offers a new approach to macroeconomics based on theories of complex systems." ~ William J. Luther

quarta-feira, 24 de fevereiro de 2021

Scarcity and Choice

Scarcity and Choice. Some fundamental considerations

Economic choice deals with scarcity because the desires of the individual exceed the availability of the means for their satisfaction. Economics comes into play when there is scarcity because scarcity makes calculation necessary.

The guiding principle in dealing with scarcity is profit. Profit is the guide to economic progress. When economic calculation shows a profit, it indicates that costs were well spent. Progress has been made. Profits appear when a human action provides more benefits than costs.

Profit is not limited to the economy but a universal category of human action. Its use in business is only a special way of the general principle when business activities allow the calculation in terms of money. Beyond business, individuals value action likewise in terms of costs and benefits. A ranking of preferences emerges as the result of these evaluations that are based on subjective valuation.

Commerce is a specific kind of universal human interaction. It widens the scope of choice. The larger the markets, the more specialization becomes possible. What begins at the level of a simple exchange within the family and the local market continues at the regional and national levels to embrace the whole globe. Behind this process lies the human desire to better one’s lot.

For markets to expand beyond the neighborhood, the exchange of goods requires money. Money is productive because it facilitates the exchange of goods and services. Without money, the exchange possibilities would be limited and thus also the specialization and the productivity. The abolition of money implies the abolition of markets and doing away with markets would lead to a collapse of productivity and thereby impoverishment would promptly follow.

With the extent of the markets, the monetary calculation comes into play. A market can be a real locality or any virtual place where demand meets supply. Money serves as a facilitator of exchange. The fundamental type of transaction is the exchange of goods (and services) against goods (and services). One buys a good by selling a good. Money comes into play as it eliminates the so-called double incidence of wants.

In the final analysis, goods have value because of the service they render. This way, by demanding a good the buyer actually wants to get a specific kind of service which this good can provide. One does not demand water per se but water only insofar as it renders certain services, be it to quench thirst or to wash a car.

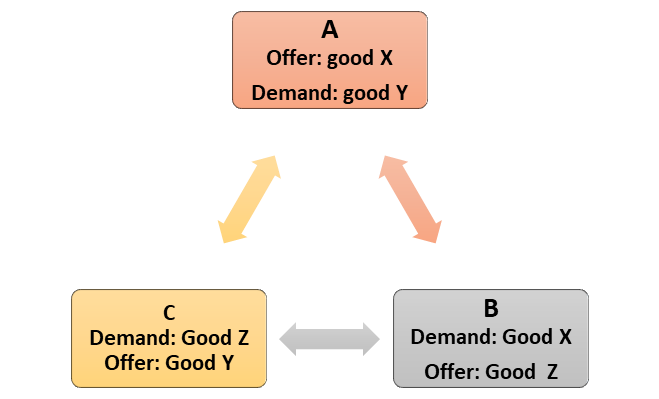

Without money, barter requires a ‘double coincidence of wants’, since the vendor must not only find someone who wants to buy his goods, but the buyer must at the same time be someone who offers the good, which the seller wants to buy.

Without money, there is no exchange of goods between A, B, and C. Although A offers the good X, which B asks, B does not have the good Y, which A asks for exchange. Likewise, C has the good Y, which A wants, but not the good X that B wants.

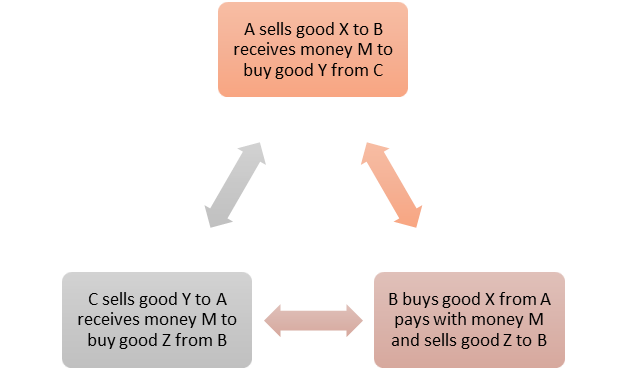

After introducing money as a general means of exchange, the problem of the so-called ‘double coincidence of wants’ finds its solution. Person A sells the good X to B who pays with money. Person A demands the good Y, which person C has to offer, and C can acquire the good Z from B.

By using money as a general means of exchange and payment, this limitation of the double coincidence of wants disappears. In a monetary economy, the respective producer exchanges his goods for money and thus gains freedom of choice as to the suppliers of the goods he wants. Money is a means of facilitating the exchange of goods, which in turn enables specialization and thereby provides the foundation of productivity.

Money is productive. It allows and facilitates the exchange of goods. Pure barter limits the size of the market. Exchange through money comes with markets, and market transactions create monetary prices. Money allows the extension of markets and thus promotes productivity and prosperity. The benign function of money becomes malignant when monetary manipulation and the abuse of money by state power corrupt the monetary systems.

Demand and supply have their origin in the division of labor. Different people do some things better or worse than other people as the result of their personal and environmental circumstances. People have different productive capacities and value goods differently. Exchange improves the well-being of the market participants because it allows the producer to concentrate on those activities where one’s productivity is high and thus allows to abandon those activities where one’s productivity is low. Thereby, commerce lifts the overall productivity of the market participants.

Trade lifts the level of productivity in the economy across the board. Likewise, commerce raises the level of satisfaction because people buy and sell goods according to their estimation of utility. Under free trade, the demand for goods reflects the relative utility that it has for different people and will be produced at the place of the highest productivity. Commerce allows the division of labor, and the division of labor increases productivity.

Monetary calculation is the tool of economic progress of the economy. Profits guide the way to the overall improvement of the individual that participates in the market. Prices emerge on markets and require money as a tool of calculation and ultimate reference of exchange. We accept a dollar bill because we can buy goods — or more specifically: valuable services — with it.

The essence of a market economy is monetary calculation. Ruining the monetary system means ruining the economy. Likewise, politically administered prices hamper the efficient allocation because they send falsified signals to the market participants. Grave economic errors are the result of falsified prices, particularly because of the governmental manipulations of important prices, including the interest and the exchange rates.

Political price interventions occur in many parts of the economy. There are price cartels, rent control, minimum wage, interest rate, exchange rate manipulation, taxes, subsidies, “free” education, “free” healthcare, state monopolies, and union power. All these interventions are highly problematic because they falsify market signals and deceive about the true relationship between wants and resources. Price and market intervention lead to distortions in the relationship between supply and demand.

The consumer uses monetary calculation as a remedial tool. His main concern is the maximization of utility. In a similar way, entrepreneurs use monetary calculation. Business firms operate with costs and revenue and calculate profit on this basis in monetary terms.

Economic competition is an eliminatory process. Different from politics where the losers stay in business. A commercial business cannot survive without profits. A prolonged period of losses leads to the elimination of the company.

Firms go out of business when the entrepreneurs fail to handle sales and costs in a profitable way. The art of business exists in the challenge that profits can only be calculated ex-post, but the business activity must be conceived ex-ante. Business action is guided by expected profits that cannot be calculated but must be anticipated based on an estimation and finally on an individual and subjective appraisal.

For any current or new project, there is a time lag between production and sales and while costs fall due now, the future prices are uncertain. When the project is of longer duration from its start until its maturity, the costs rise to more uncertainty. Many things can happen and do happen between the time of the conception of the project, its realization, and the sale of the products. Economic production is not just risk but must deal with uncertainty.

In a market economy, the production serves the consumer. The consumer is the focal point of the economy. Consumption is the raison d’être of production. The individual consumer makes the final decision of the production. The individual choices about final consumption decide about which companies may go on to produce and which must stop and leave the market.

Assinar:

Postagens (Atom)

#freesociety #freedomofexpression #freedom #inflation #ecb #federalreserve #euro #dollar #supranational #g20 #oecd #parliament #debts #covıd #marxism