Has the rethinking of macroeconomic policy been successful?

The great financial crash of 2008 was expected to lead to a fundamental re-thinking of macro-economics, perhaps leading to a profound shift in the mainstream approach to fiscal, monetary and international policy. That is what happened after the 1929 crash and the Great Depression, though it was not until 1936 that the outline of the new orthodoxy appeared in the shape of Keynes’ General Theory. It was another decade or more before a simplified version of Keynes was routinely taught in American university economics classes. The wheels of intellectual change, though profound in retrospect, can grind fairly slowly.

Seven years after 2008 crash, there is relatively little sign of a major transformation in the mainstream macro-economic theory that is used, for example, by most central banks. The “DSGE” (mainly New Keynesian) framework remains the basic workhorse, even though it singularly failed to predict the crash. Economists have been busy adding a more realistic financial sector to the structure of the model [1], but labour and product markets, the heart of the productive economy, remain largely untouched.

What about macro-economic policy? Here major changes have already been implemented, notably in banking regulation, macro-prudential policy and most importantly the use of the central bank balance sheet as an independent instrument of monetary policy. In these areas, policy-makers have acted well in advance of macro-economic researchers, who have been struggling to catch up.

The IMF has tracked this process well, and it has just held its third post-2008 conference on Rethinking Macro Policy under the leadership of chief economist Olivier Blanchard. Olivier has summarised the conference (here and here) but so far it has it not been much discussed by macro investors.

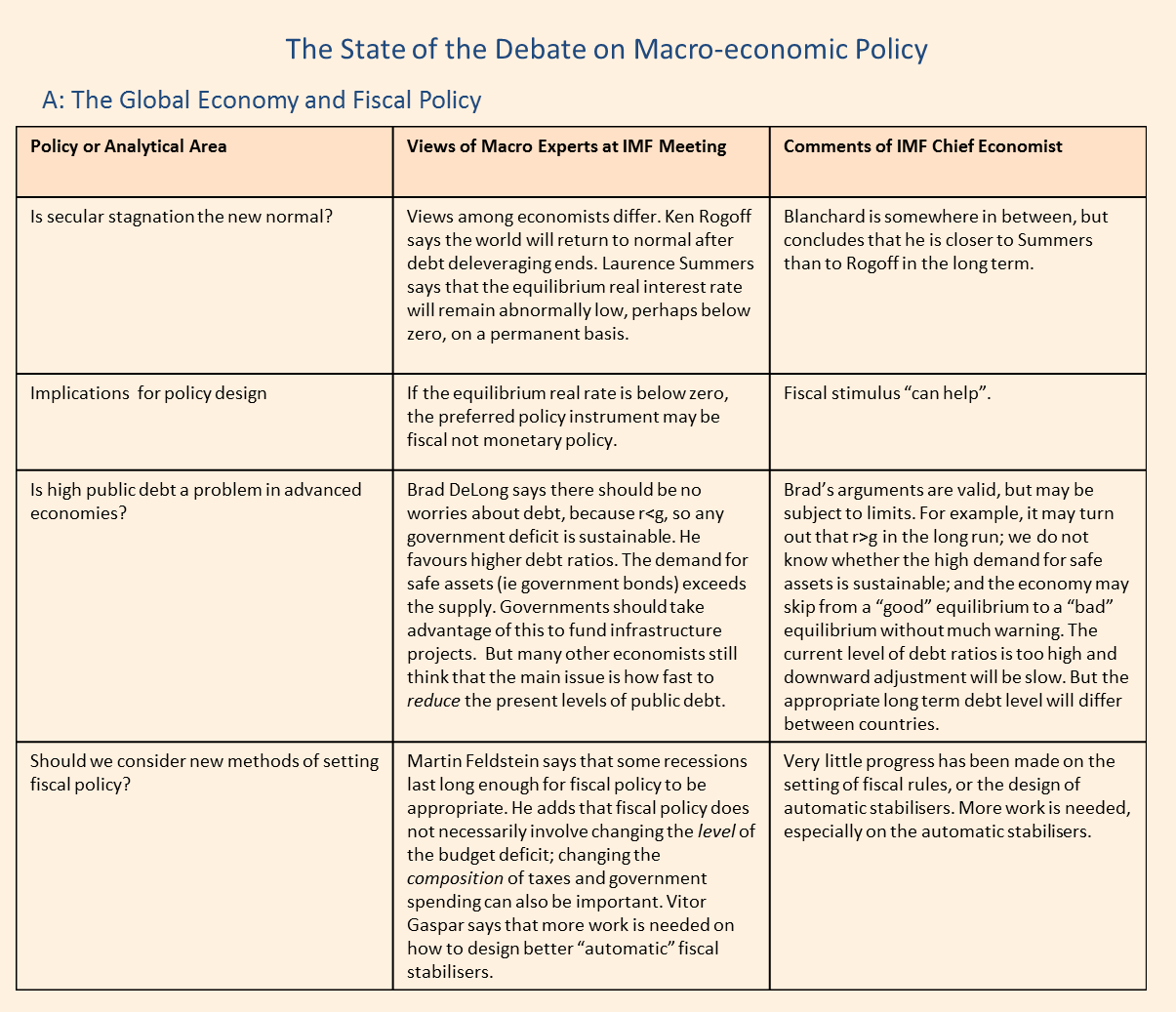

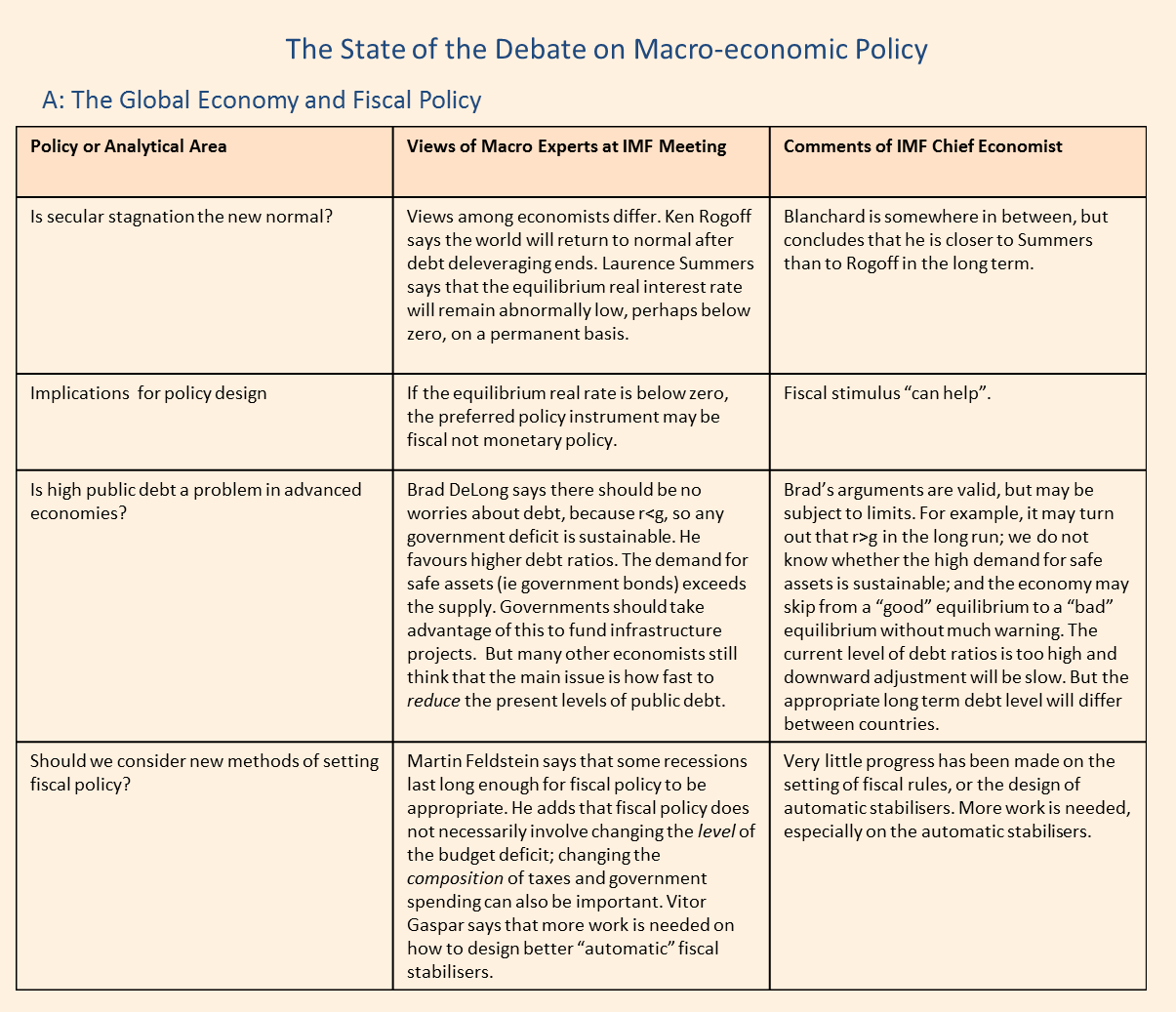

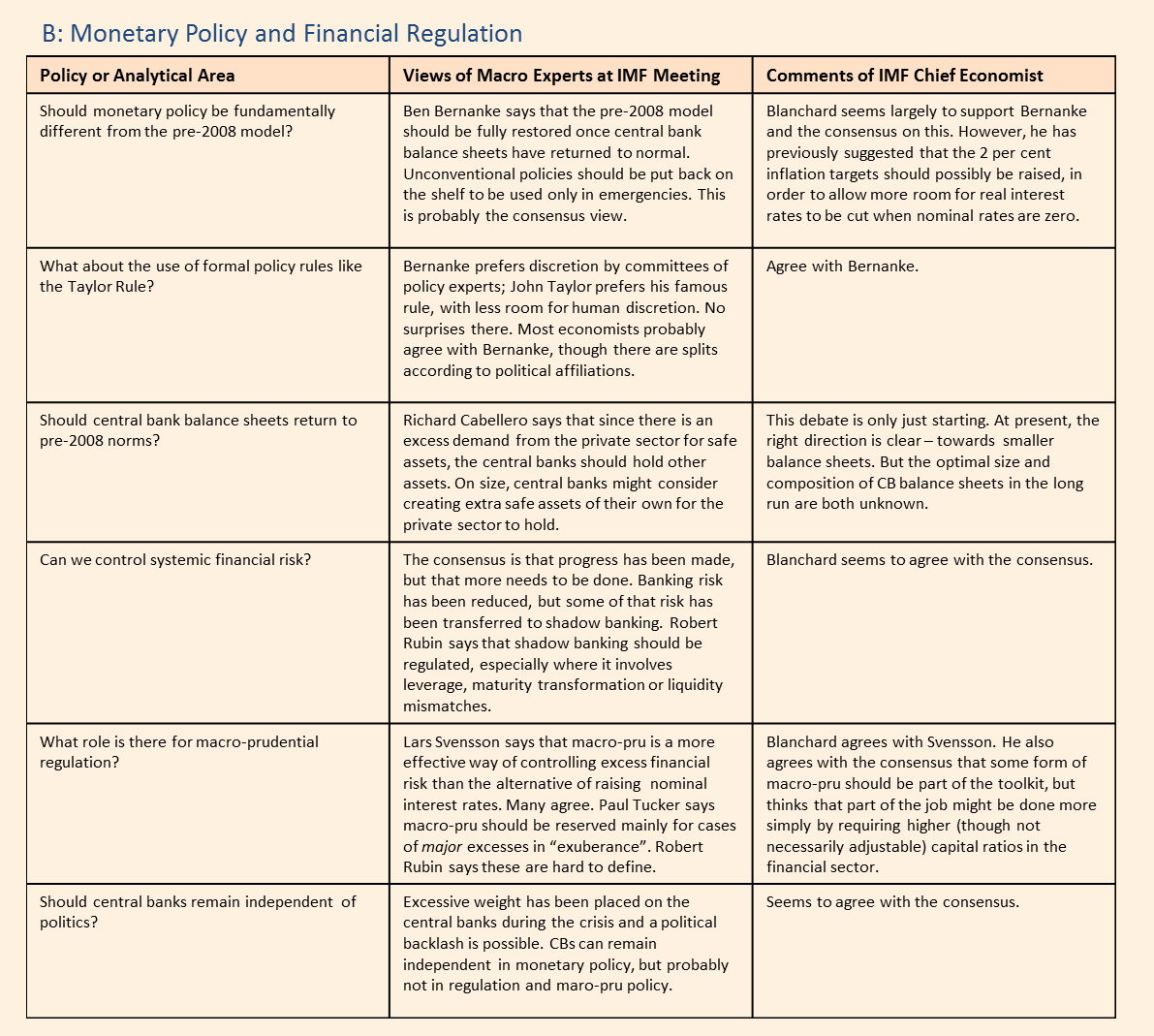

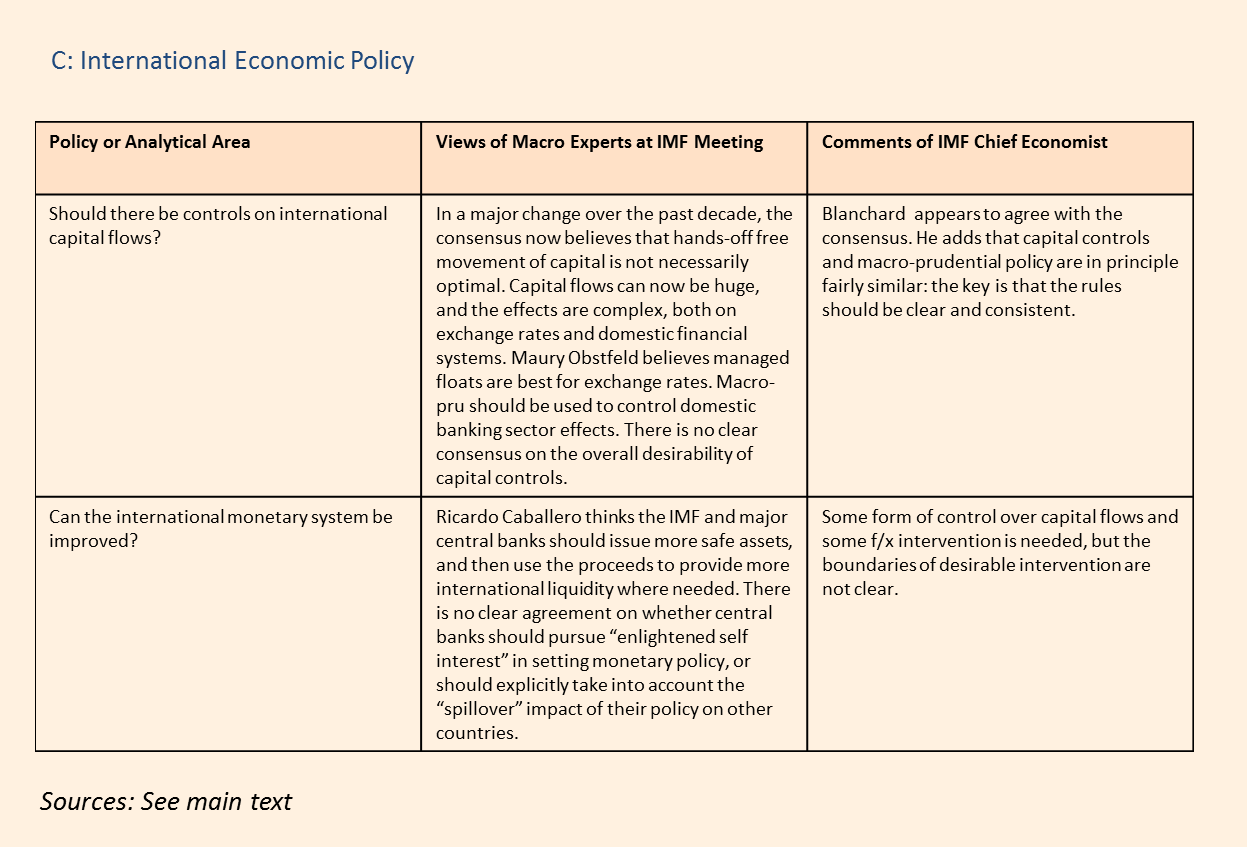

I have therefore taken the liberty of organising Olivier’s summary and the conference material into the three tables below. Although highly simplified, the tables represent a snapshot of the current “state of the art” in macro policy, at least as seen by today’s mainstream luminaries of the subject.

The far right hand column in each table is devoted to Blanchard’s own views, since his status at the IMF probably makes him “team captain” of mainstream policy economists at present. (Unorthodox economists are another set entirely, and were largely unrepresented at the IMF conference, which does not imply that they are insignificant [2].)

First, the state of the economy and fiscal policy. An important debate is on whether Lawrence Summers is right to warn about secular stagnation, and if so, why? There is certainly no consensus on this. Most central bankers say that they disagree with Summers (agreeing instead with Ken Rogoff that stagnation will disappear once debt deleveraging is over), but that may be because they do not want to face the policy consequences of him being proved right. Blanchard and the IMF research department seem more favourably disposed towards Summers, as are the bond markets, which are pricing in much lower than normal equilibrium real rates of interest. A major adjustment in market rates would become necessary if Summers is wrong.

This debate is closely linked to the future role of fiscal policy in managing demand. If Summers is right, then the equilibrium real interest rate may be substantially below zero, and any future downturn in demand may need to be addressed by fiscal policy, not monetary policy.

Some Keynesian economists, like Paul Krugman and Brad DeLong, want this to happen anyway, and are not worried about a rise in public debt. Others, like the IMF, are somewhat sympathetic to this Keynesian view, but would prefer public debt to be brought down gradually. The latter is probably the mainstream view at present, but there is broad agreement that more public infrastructure spending is desirable, even if funded by extra public debt issued at very low real interest rates.

The most important issue, however, is left largely undiscussed in the IMF conference. Whatever economists may think, politicians seem to be far more convinced that a reduction in public debt is essential and, as in the 1950s, they appear willing to “repress” returns on outstanding public debt to achieve this. What would happen to the fiscal stance if faced with another recession is unknown.

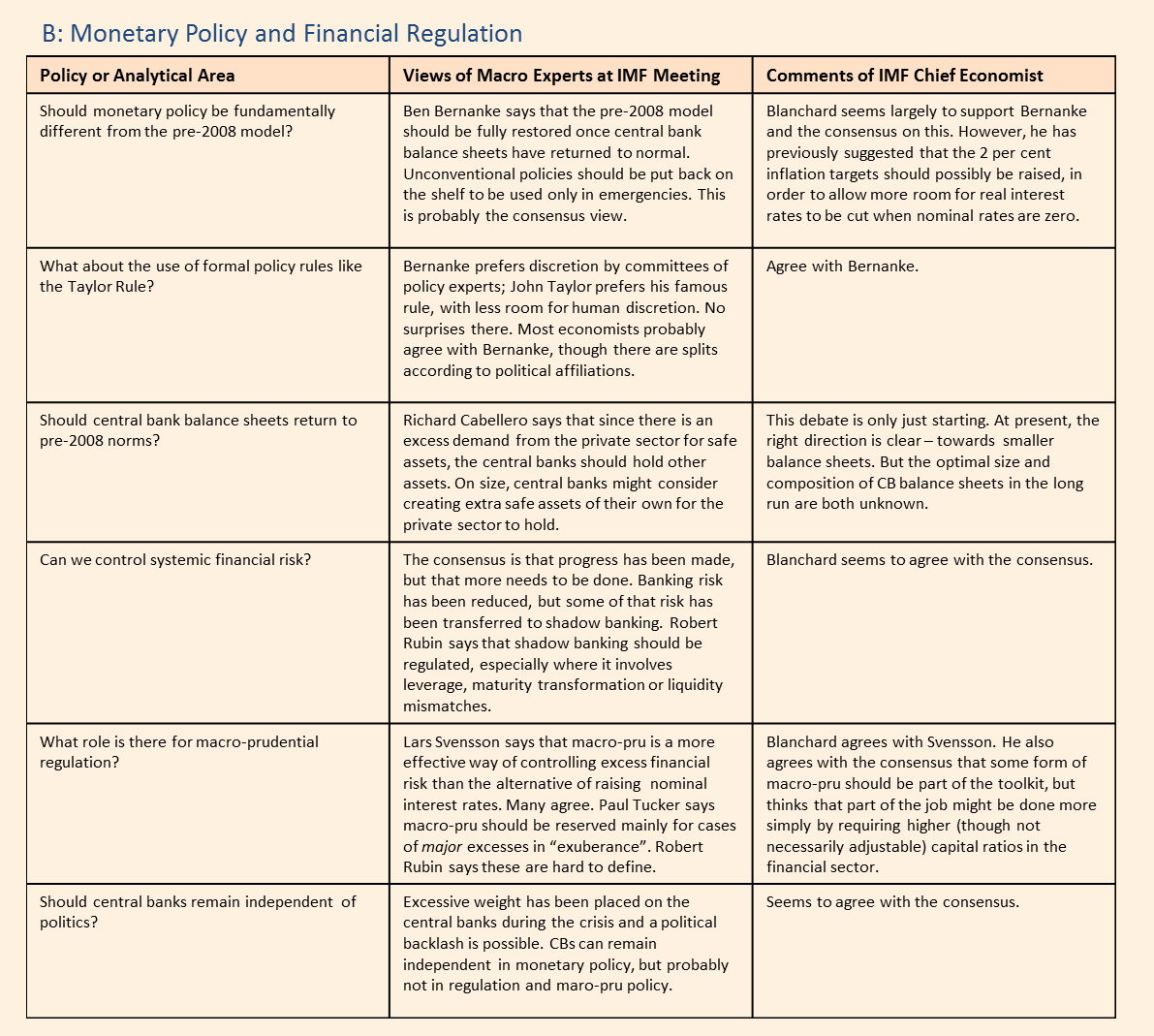

Second, monetary policy and financial regulation.

The pre-2008 mainstream view of traditional monetary policy, involving inflation targeting, enforced by variations in short rates, seems to have survived largely intact. There is relatively little support for running policy solely according to the Taylor Rule. But there is great uncertainty about how far central bank balance sheets should be reduced, and whether they should retain an independent role in monetary policy in future. These shifting sands obviously leave open the possibility that balance sheets will never be returned to pre-2008 norms. The question of how to deal with a deflation threat, if it should return, was largely ignored, which is odd.

On regulation, there is widespread agreement that macro-prudential policy weapons are desirable, but little agreement on what they should be, or how they should be deployed. Nevertheless, in an impressive act of faith by policy-makers, they have now been rolled out in almost all international jurisdictions.

There is rising concern that the shadow banking system should be regulated, so investors in financial sector assets should watch this space closely.

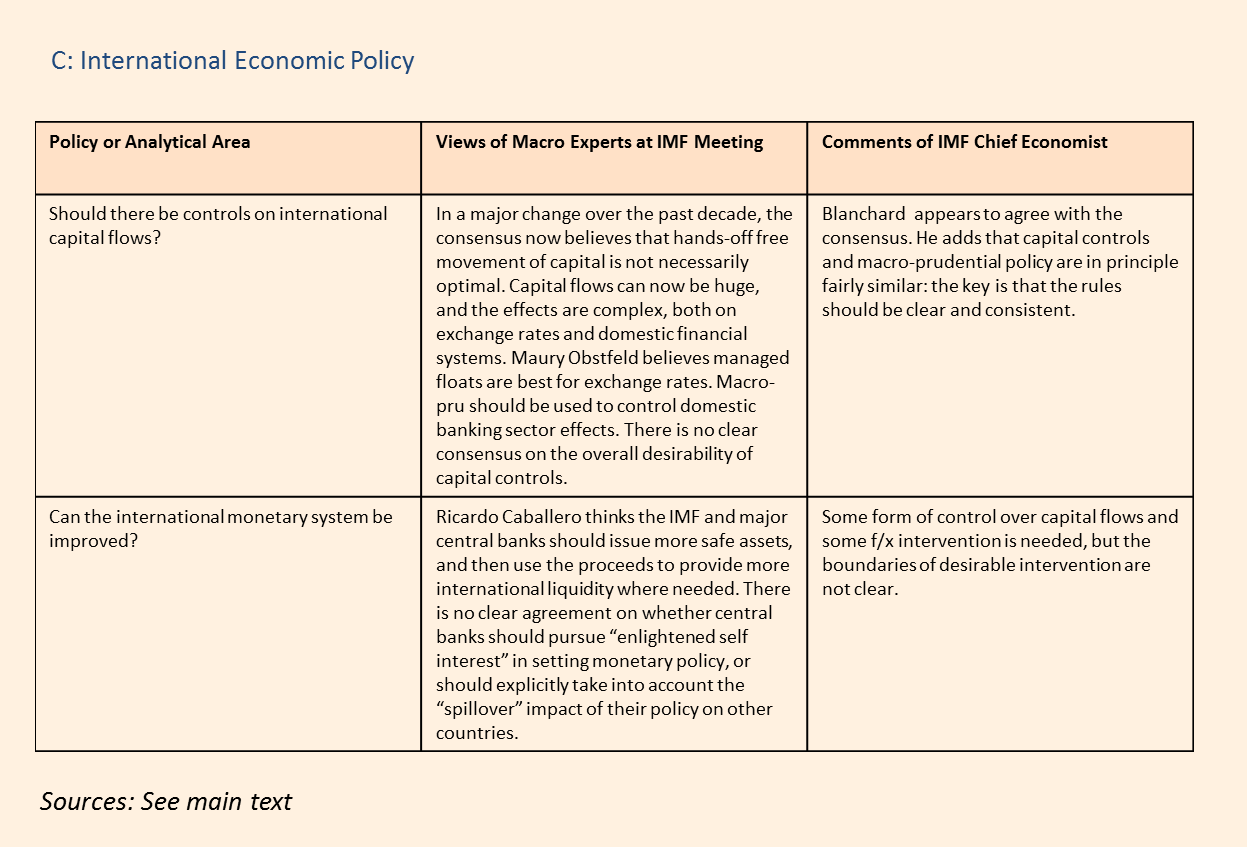

Third, international economic policy.

There has been a decisive shift away from a belief in complete freedom of capital movements, notably towards emerging economies. There is also a tendency to see managed floats as the most suitable form of exchange rate management. But the discussion on the need for co-operation between central banks when setting domestic monetary policy – a very live issue ahead of Federal Reserve tightening – was inconclusive. The central banks need more clarity from international economists on this topic.

In conclusion, what should we expect from macro-policy makers in future, assuming the economic back-drop remains relatively benign? Probably, more of the same: broadly stable central bank balance sheets, very slow declines in public debt ratios and a gradual return to using interest rates as the main weapon of monetary policy. A more rapid return to pre-2008 norms for fiscal and central bank balance sheets is somewhat unlikely.

It is worth stressing that the current mainstream debate is largely focused on how macro policy should be designed in periods, as now, when inflation and unemployment are both broadly “acceptable”, and when there is no obvious emergency at hand.

The much more serious challenge of how policy should adjust in the event of another crisis – a renewed recession; a major outbreak of deflation; a permanent slowdown in productivity growth; a political crisis over rising inequality; or a financial disruption, such as a Chinese debt implosion or a break-up in the euro – were not much addressed at the recent IMF gathering.

In the not-very-unlikely event of any of these threats manifesting themselves, there is no obvious “play-book” being presented by mainstream macro-economists to future policy makers. As in 2008, policy-makers would have to fend for themselves, but with far fewer options available to them.

———————————————————————————————————

Footnotes

[1] See for example this new IMF model, and comments by the always excellent Simon Wren Lewis and listen to Wouter den Haan.

[2] Fortunately, the Institute for New Economic Thinking (INET) and the Cambridge-INET Institute fill part of this omission.

Fonte:

http://blogs.ft.com/gavyndavies/2015/05/31/has-the-rethinking-of-macro-economic-policy-been-successful/?

Seven years after 2008 crash, there is relatively little sign of a major transformation in the mainstream macro-economic theory that is used, for example, by most central banks. The “DSGE” (mainly New Keynesian) framework remains the basic workhorse, even though it singularly failed to predict the crash. Economists have been busy adding a more realistic financial sector to the structure of the model [1], but labour and product markets, the heart of the productive economy, remain largely untouched.

What about macro-economic policy? Here major changes have already been implemented, notably in banking regulation, macro-prudential policy and most importantly the use of the central bank balance sheet as an independent instrument of monetary policy. In these areas, policy-makers have acted well in advance of macro-economic researchers, who have been struggling to catch up.

The IMF has tracked this process well, and it has just held its third post-2008 conference on Rethinking Macro Policy under the leadership of chief economist Olivier Blanchard. Olivier has summarised the conference (here and here) but so far it has it not been much discussed by macro investors.

I have therefore taken the liberty of organising Olivier’s summary and the conference material into the three tables below. Although highly simplified, the tables represent a snapshot of the current “state of the art” in macro policy, at least as seen by today’s mainstream luminaries of the subject.

The far right hand column in each table is devoted to Blanchard’s own views, since his status at the IMF probably makes him “team captain” of mainstream policy economists at present. (Unorthodox economists are another set entirely, and were largely unrepresented at the IMF conference, which does not imply that they are insignificant [2].)

First, the state of the economy and fiscal policy. An important debate is on whether Lawrence Summers is right to warn about secular stagnation, and if so, why? There is certainly no consensus on this. Most central bankers say that they disagree with Summers (agreeing instead with Ken Rogoff that stagnation will disappear once debt deleveraging is over), but that may be because they do not want to face the policy consequences of him being proved right. Blanchard and the IMF research department seem more favourably disposed towards Summers, as are the bond markets, which are pricing in much lower than normal equilibrium real rates of interest. A major adjustment in market rates would become necessary if Summers is wrong.

This debate is closely linked to the future role of fiscal policy in managing demand. If Summers is right, then the equilibrium real interest rate may be substantially below zero, and any future downturn in demand may need to be addressed by fiscal policy, not monetary policy.

Some Keynesian economists, like Paul Krugman and Brad DeLong, want this to happen anyway, and are not worried about a rise in public debt. Others, like the IMF, are somewhat sympathetic to this Keynesian view, but would prefer public debt to be brought down gradually. The latter is probably the mainstream view at present, but there is broad agreement that more public infrastructure spending is desirable, even if funded by extra public debt issued at very low real interest rates.

The most important issue, however, is left largely undiscussed in the IMF conference. Whatever economists may think, politicians seem to be far more convinced that a reduction in public debt is essential and, as in the 1950s, they appear willing to “repress” returns on outstanding public debt to achieve this. What would happen to the fiscal stance if faced with another recession is unknown.

Second, monetary policy and financial regulation.

The pre-2008 mainstream view of traditional monetary policy, involving inflation targeting, enforced by variations in short rates, seems to have survived largely intact. There is relatively little support for running policy solely according to the Taylor Rule. But there is great uncertainty about how far central bank balance sheets should be reduced, and whether they should retain an independent role in monetary policy in future. These shifting sands obviously leave open the possibility that balance sheets will never be returned to pre-2008 norms. The question of how to deal with a deflation threat, if it should return, was largely ignored, which is odd.

On regulation, there is widespread agreement that macro-prudential policy weapons are desirable, but little agreement on what they should be, or how they should be deployed. Nevertheless, in an impressive act of faith by policy-makers, they have now been rolled out in almost all international jurisdictions.

There is rising concern that the shadow banking system should be regulated, so investors in financial sector assets should watch this space closely.

Third, international economic policy.

There has been a decisive shift away from a belief in complete freedom of capital movements, notably towards emerging economies. There is also a tendency to see managed floats as the most suitable form of exchange rate management. But the discussion on the need for co-operation between central banks when setting domestic monetary policy – a very live issue ahead of Federal Reserve tightening – was inconclusive. The central banks need more clarity from international economists on this topic.

In conclusion, what should we expect from macro-policy makers in future, assuming the economic back-drop remains relatively benign? Probably, more of the same: broadly stable central bank balance sheets, very slow declines in public debt ratios and a gradual return to using interest rates as the main weapon of monetary policy. A more rapid return to pre-2008 norms for fiscal and central bank balance sheets is somewhat unlikely.

It is worth stressing that the current mainstream debate is largely focused on how macro policy should be designed in periods, as now, when inflation and unemployment are both broadly “acceptable”, and when there is no obvious emergency at hand.

The much more serious challenge of how policy should adjust in the event of another crisis – a renewed recession; a major outbreak of deflation; a permanent slowdown in productivity growth; a political crisis over rising inequality; or a financial disruption, such as a Chinese debt implosion or a break-up in the euro – were not much addressed at the recent IMF gathering.

In the not-very-unlikely event of any of these threats manifesting themselves, there is no obvious “play-book” being presented by mainstream macro-economists to future policy makers. As in 2008, policy-makers would have to fend for themselves, but with far fewer options available to them.

———————————————————————————————————

Footnotes

[1] See for example this new IMF model, and comments by the always excellent Simon Wren Lewis and listen to Wouter den Haan.

[2] Fortunately, the Institute for New Economic Thinking (INET) and the Cambridge-INET Institute fill part of this omission.

Fonte:

http://blogs.ft.com/gavyndavies/2015/05/31/has-the-rethinking-of-macro-economic-policy-been-successful/?

Nenhum comentário:

Postar um comentário